Introduction: The LFP Revolution in Context

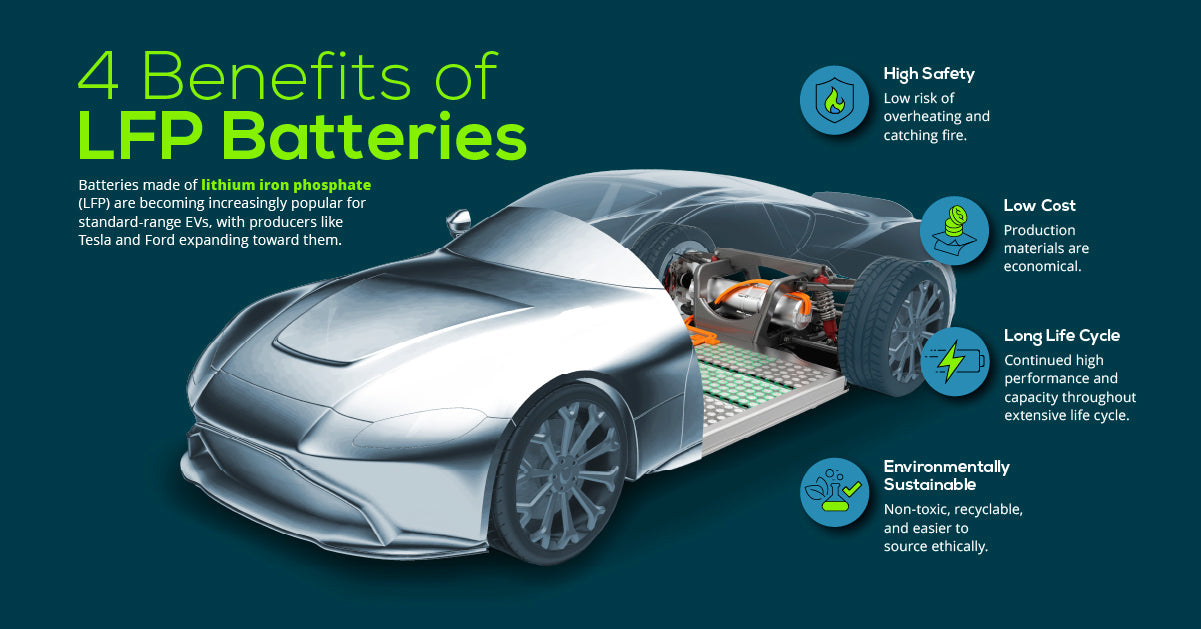

Enhanced safety (stable thermal properties)

Longer cycle life (3,000-10,000 cycles)

Growing adoption by industry leaders:

Tesla's 2021 shift to LFP for standard-range vehicles

Ford's $3.5B LFP plant collaboration with CATL

Energy storage systems (ESS) accounting for 40% of LFP demand

Chapter 1: The Tariff Landscape (800 words)

1.1 U.S. Policy Framework

Section 301 tariffs: 25% on Chinese batteries (since 2018)

Inflation Reduction Act (IRA) provisions:

$45/kWh tax credit for domestic battery production

"Foreign Entity of Concern" restrictions post-2024

Bipartisan Infrastructure Law's $7B battery supply chain funding

1.2 Global Countermeasures

EU's Carbon Border Adjustment Mechanism (CBAM)

China's export controls on graphite (70% of global supply)

Indonesia's nickel export ban (critical for NMC batteries)

1.3 Case Study: CATL's Michigan Plant Controversy

Technology licensing model vs. traditional FDI

DOE's national security review process

Implications for knowledge transfer

Chapter 2: Supply Chain Realignment (1200 words)

2.1 The China+1 Strategy

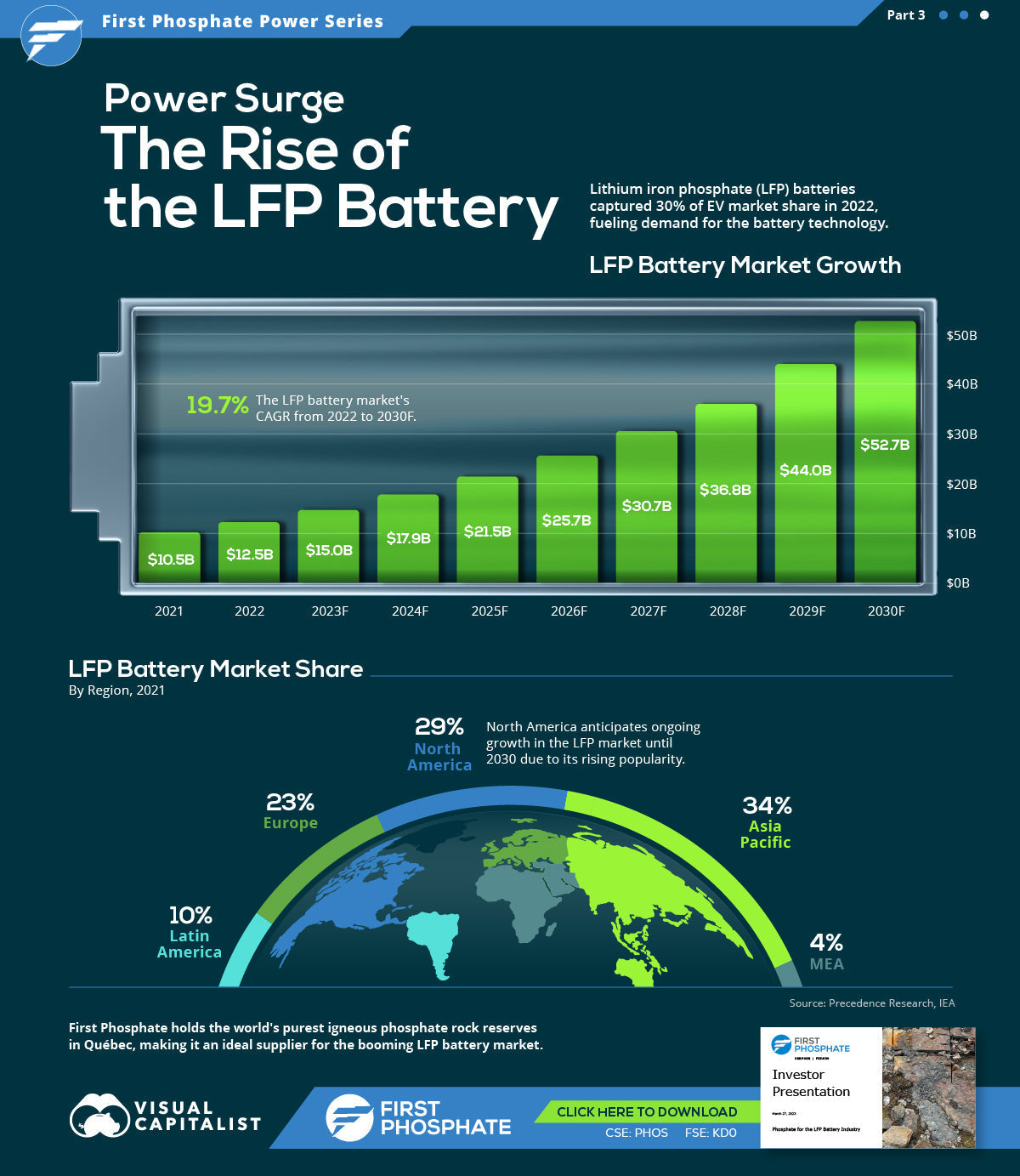

Data snapshot: 85% of LFP cathode production in China (2023)

Emerging production hubs:

Morocco (geographic advantage: 9-day shipping to U.S.)

Vietnam (VinES's $1B LFP facility)

Texas (Titan Advanced Energy's $150M plant)

2.2 Raw Material Chess Game

Lithium: U.S. production up 400% since 2020 (Thacker Pass)

Iron phosphate: Pallinghurst Group's $300M Tennessee investment

Recycling infrastructure gap: <5% of U.S. batteries currently recycled

2.3 Logistics Reengineering

Cost comparison:

Route Pre-Tariff Cost Post-Tariff Cost

Shanghai-LA $2,800/FEU $4,100/FEU

Hanoi-LA $3,200/FEU $3,200/FEU

Critical mineral mapping:

Chapter 3: Technological Arms Race (1000 words)

3.1 Performance Breakthroughs

CATL's Shenxing Battery: 400km range with 10-min charging

BYD's Blade Battery: 43% higher volume efficiency

U.S. National Labs' dry electrode manufacturing advancements

3.2 Patent Wars

Key IP holders:

University of Texas (Goodenough patents expired 2020)

Hydro-Québec's ongoing royalty claims

Tesla's LFP-related patent portfolio (63 granted in 2023)

3.3 Alternative Chemistries

Sodium-ion batteries: CATL's planned 2024 mass production

LMFP (Lithium Manganese Iron Phosphate) hybrids

U.S. DOE's $125M funding for solid-state LFP research

Chapter 4: Market Dynamics (1500 words)

4.1 Pricing Paradox

LFP price trends:

Year Price ($/kWh)

2021 105

2023 82

2025 (proj.) 68

Tariff impact analysis:

25% duty adds

17.50

−

17.50−25/kWh for Chinese imports

IRA credits offset 65% of domestic production costs

4.2 Automotive Sector Shifts

OEM adoption timeline:

Automaker LFP Implementation

Tesla 2021 (Model 3 SR)

Ford 2024 (Mustang Mach-E)

Rivian 2025 (R2 platform)

Consumer behavior data:

62% of EV buyers prioritize cost over range (JD Power 2023)

4.3 Energy Storage Gold Rush

U.S. utility-scale ESS pipeline: 136 GW by 2030

Fire safety regulations in 28 states

Conclusion: The New Energy World Order (500 words)

Three probable scenarios:

Fragmented Markets (40% probability): Regional supply chains

Tech Leapfrogging (35%): Next-gen batteries disrupt LFP

Resource Nationalism (25%): Export controls escalate

Strategic recommendations:

For manufacturers: Dual sourcing by 2025 Q2

For policymakers: Critical mineral stockpiling

For investors: Vertical integration opportunities

Appendices (Expandable Sections):

Detailed tariff schedules (HTS codes 8507.60.00 etc.)

LFP vs. NMC technical comparison table

U.S. LFP production facility map

2030 demand projections by sector

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.