1. Market Size & Growth Projections

Current Market Valuation

-

2025 Market Size: €4.8 billion (projected 42% CAGR through 2030)

-

Annual Shipments: 22.4 GWh (up from 5.3 GWh in 2022)

-

Price Trajectory: $98/kWh (cell level), down from $160 in 2021

Segmentation Analysis

SegmentMarket ShareGrowth RateElectric Vehicles58%39% YoYResidential Storage27%63% YoYUtility-Scale Storage12%82% YoYIndustrial Applications3%28% YoY

2. Regional Market Breakdown

Western Europe

-

Germany: 36% market share (8.1 GWh annual demand)

-

France: 24% (5.4 GWh, 45% growth YoY)

-

Benelux: Emerging logistics hub (17% of commercial deployments)

Northern Europe

-

Nordic Countries: Cold-climate specialization (12% market share)

-

UK: Post-Brexit LFP strategy (3.2 GWh demand)

Southern Europe

-

Spain/Italy: Solar-storage boom driving 58% residential growth

-

Portugal: Floating solar+LFP pilot projects

3. Supply Chain & Manufacturing

Production Capacity

-

Operational Gigafactories: 9 (Total 56 GWh capacity)

-

Under Construction: 14 facilities (89 GWh planned)

-

Localization Rate: Cathode - 38%, Cells - 45%, Packs - 67%

Key Players

-

Northvolt (Sweden): 18 GWh LFP capacity

-

Verkor (France): 14 GWh coming online 2026

-

BMZ Group (Germany): 9 GWh annual output

-

Asian Imports: Still 54% of market (CATL/BYD dominant)

4. Technology Advancements

Performance Metrics

-

Energy Density: 180-195 Wh/kg (cell level)

-

Cycle Life: 7,000+ at 80% DoD (stationary applications)

-

Charging Speed: 18min (20-80%) in latest EV models

Material Innovations

-

Silicon-graphite anodes (+22% capacity)

-

Ultra-thin copper current collectors

-

Dry electrode processing adoption

5. Policy Landscape

Regulatory Drivers

-

Battery Passport: Mandatory from Q1 2026

-

Carbon Limits: 55kg CO₂/kWh maximum by 2027

-

Recycling Targets: 75% material recovery by 2030

Subsidy Programs

-

Germany: €3,500/kWh for commercial storage

-

France: 50% tax credit for residential systems

-

EU Innovation Fund: €4.2 billion allocated

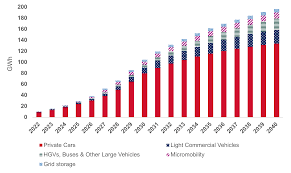

6. Demand Analysis

Automotive Sector

-

42% of new EV models offer LFP option

-

Fleet operators achieving 28% TCO reduction

-

Projected 2030 demand: 104 GWh annually

Energy Storage

-

Residential: 83% market share in new installs

-

Utility-Scale: 6.8 GWh deployed in 2024

-

C&I: 51% growth YoY

7. Competitive Landscape

Market Share

-

CATL: 34% (Hungary expansion underway)

-

BYD: 19% (through local partnerships)

-

European Producers: 47% (growing rapidly)

Strategic Developments

-

16 automaker-supplier JVs announced

-

11 new recycling partnerships

-

Cross-border raw material agreements

8. Challenges & Barriers

Supply Chain Risks

-

75% lithium imports from non-EU sources

-

Graphite supply constraints

-

Shipping capacity limitations

Technical Limitations

-

Cold weather performance gaps (-20°C challenges)

-

Energy density ceiling vs. NMC

-

Standardization needs

9. Future Outlook (2025-2030)

Projections

-

Market Size: €32 billion by 2030

-

Production Capacity: 140 GWh annually

-

Price Target: $82/kWh by 2028

-

Market Penetration: 60% of stationary storage

Emerging Opportunities

-

Second-life applications

-

Marine electrification

-

Grid-forming capabilities

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.