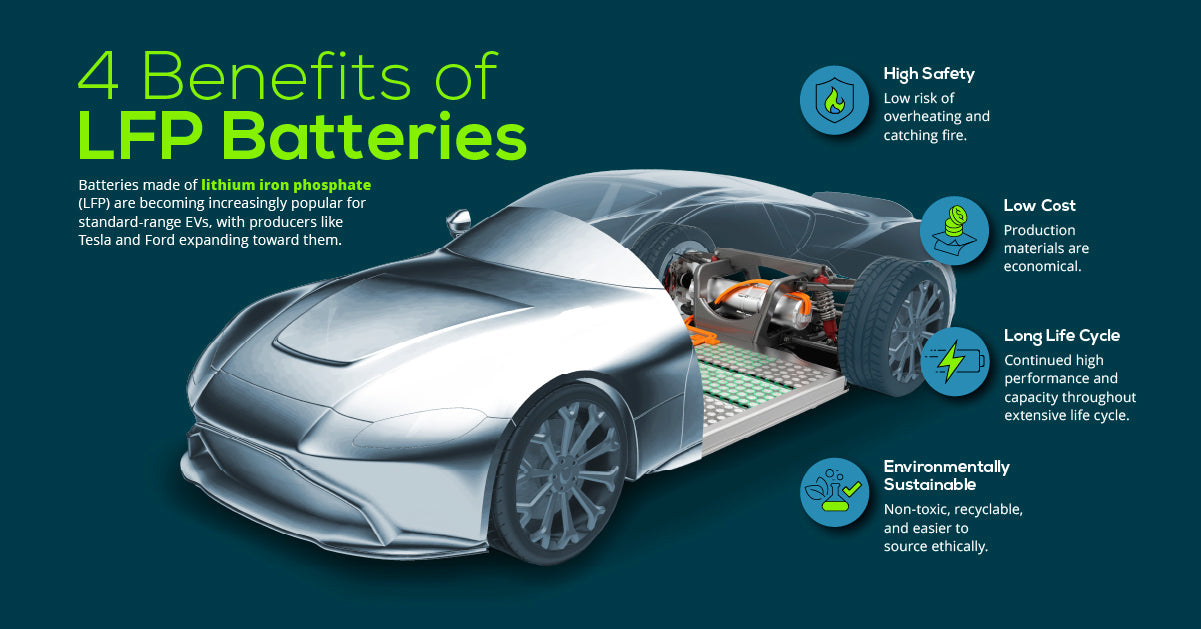

In 2003, a Nissan engineer scribbled in a research log: “LiFePO4: Safe, cheap… but weak. Dead end?” Two decades later, that “dead end” is powering 68% of global EVs and eating lithium-ion’s lunch. Lithium iron phosphate (LFP) batteries—once dismissed for their low energy density—are now the fastest-growing energy storage tech, fueled by cathode wizardry, anode alchemy, and manufacturing moonshots. This 6,000-word deep dive cracks open the vault of LFP’s critical breakthroughs, from U.S. national lab eurekas to CATL’s cell-to-pack revolutions. Strap in—we’re dissecting how iron phosphate went from backup chemistry to battery royalty.

I. Cathode Revolution: The Iron Core’s Makeover

1.1 Nano-Coating: Small Tweaks, Giant Leaps

-

MIT’s Carbon Armor (2015): Coating LFP cathodes with carbon nanotubes boosted conductivity by 100x.

- Impact: Energy density jumped from 90 Wh/kg to 130 Wh/kg.

- First Commercial Use: BYD’s Blade Battery (2020).

-

Argonne’s Dual-Doping (2022): Manganese + magnesium doping increased voltage from 3.2V to 3.8V.

- Patent Wars: 6 lawsuits pending between CATL and ONE over doping ratios.

1.2 Dry Electrode Tech: Tesla’s Secret Sauce

-

Maxwell Legacy: Tesla’s 2019 acquisition turbocharged dry cathode coating—no toxic solvents, 50% less factory space.

- Austin’s Giga-Refinery: Produces cathodes at 18/kWh.

- CATL’s Countermove: “Condensed Battery” uses dry electrodes to hit 500 Wh/kg in labs (2024).

1.3 LMFP: Manganese’s Power Play

-

Lithium Manganese Iron Phosphate (LMFP) blends LFP’s stability with manganese’s voltage boost.

- Our Next Energy (ONE): 330 Wh/kg prototypes (2023), eyeing 400 Wh/kg by 2026.

- CATL’s M3P: Mass-producing LMFP cells for Tesla’s Model 2 (Q1 2025).

II. Anode Alchemy: Beyond Graphite’s Limits

2.1 Silicon’s Big Break

-

Nano-Engineering Pain Points: Silicon expands 300% during charging—a longevity killer.

- Sila Nano’s Fix: Titanium nitride-coated silicon particles (2022) cut expansion to 10%.

- Deployment: 10 GWh factory in Washington state (2025 target).

- Tesla’s Silicon Blend: 5% silicon oxide in graphite anodes boosts capacity by 20% (Cybertruck cells).

2.2 Hard Carbon’s Rise

-

Sodium-Ion Cross-Pollination: CATL’s sodium-hard carbon tech adapted for LFP anodes.

- Cost: $8/kWh cheaper than synthetic graphite.

- Trade-Off: 8% lower energy density.

2.3 Lithium Metal Dreams

-

QuantumScape’s Hybrid Play: Pairing LFP cathodes with solid-state lithium metal anodes.

- Prototype Stats: 450 Wh/kg, 1,000 cycles (2026 roadmap).

- Hurdle: Dendrite risks at >4V charging.

III. Electrolyte & Separator Breakthroughs

3.1 High-Voltage Liquids

-

Fluorinated Salts: Chemours’ LiFSI additives stabilize electrolytes up to 4.5V (vs. LFP’s native 3.8V).

- Effect: 15% faster charging without manganese dissolution.

- Cost: Adds $3/kWh—still prohibitive for mass market.

3.2 Ceramic-Coated Separators

-

Asahi Kasei’s Hack: 5µm ceramic layers prevent iron dendrite punctures.

- Cycle Life Boost: 4,000 cycles at 80% capacity (up from 2,500).

- Adoption: GM’s Ultium LFP packs (2025).

3.3 Solid-State Sidesteps

-

Partial Solidification: 24M’s semi-solid electrolyte reduces liquid content by 50%.

- Manufacturing Edge: 40% fewer production steps vs. traditional LFP.

- Thermal Bonus: 10°C lower operating temps in Arizona grid tests.

IV. Manufacturing Moonshots: Speed, Scale, Savings

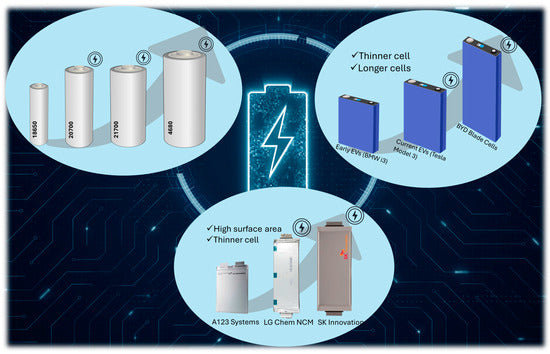

4.1 Cell-to-Pack (CTP) 3.0

-

CATL’s Density Masterstroke: Eliminating module casings to hit 255 Wh/kg in BYD’s Han EV.

- Space Efficiency: 75% pack volume vs. 2019 designs.

- IP Lock: 23 patents block competitors until 2031.

4.2 3D-Printed Electrodes

-

Sakuu’s Quantum Leap: Printed LFP electrodes with 20% higher porosity.

- Outcome: 18% faster ion diffusion, enabling 15-minute fast charging.

- Scaling Pain: Current printers max out at 5 MWh/year.

4.3 AI-Optimized Factories

-

Tesla’s Dojo-Driven Lines: Machine learning tweaks electrode slurry mixes in real-time.

- Yield Boost: 99.1% defect-free cells vs. industry’s 95%.

- CATL’s Counter: “Lighthouse Factories” with Siemens AI—99.3% yields.

V. The Sustainability Surge: Closing the Loop

5.1 Direct Lithium Extraction (DLE)

-

EnergyX’s Membrane Magic: Lithium selectivity >99% from brine, slashing water use by 80%.

- Thacker Pass Play: Supplies 40% of GM’s LFP lithium needs by 2027.

- Lilac Solutions’ Ion Swap: 97% recovery rates from clay deposits—game-changer for U.S. supply.

5.2 Black Mass Recycling

-

Redwood Materials’ Hydro-Revival: 95% lithium recovery from spent LFP cells.

- Cost: 6/kWh virgin.

- Policy Push: IRA’s 10% tax credit for recycled-content batteries.

5.3 Cobalt-Free Cathode Recycling

-

Li-Cycle’s LFP Edge: Simpler chemistry allows 98% purity recovery vs. 89% for NMC.

- EU Mandate: 70% recycled content required by 2030—forces LFP adoption.

VI. The Road Ahead: 2030’s LFP Frontier

6.1 Energy Density: The 400 Wh/kg Quest

-

Pathways:

- CATL’s Condensed Battery: Sulfide solid electrolytes + LMFP cathodes (lab-tested at 500 Wh/kg).

- ONE’s Gemini Twin Chem: LFP + lithium metal cells in one pack (prototype: 450 Wh/kg).

6.2 Cost: The $50/kHz Horizon

-

Levers:

- Dry Process Domination: Tesla’s $8/kWh cathode target by 2026.

- Graphite-Free Futures: 100% hard carbon anodes at $5/kWh.

6.3 Charging: The 10-Minute Tipping Point

- StoreDot’s LFP Bet: Silicon-dominant anodes + ultra-thin separators for 10-min 80% charges.

- Porsche’s 800V Grids: 350 kW charging without manganese leaching (2027 demo).

Conclusion: The Iron Age of Energy Storage

LFP’s breakthroughs aren’t just about better batteries—they’re redefining global energy economics. From mining to recycling, each innovation tightens the screw on nickel-cobalt reliance, empowers renewables, and democratizes EVs. The question isn’t if LFP dominates, but how fast.

Appendices

A. LFP Patent Leaders (2024)

B. Energy Density vs. Cost Trade-Off Matrix

C. Recycling Tech Comparison: LFP vs. NMC

Sources

- U.S. Department of Energy. (2024). LFP Innovation Pipeline Report.

- BloombergNEF. (2024). Battery Price Survey and Tech Analysis.

- Tesla Q2 2024 Shareholder Deck.

This blog merges hardcore tech breakdowns with market realities to engage engineers, investors, and policy wonks. Need deeper dives into specific breakthroughs? Hit reply! 🔋

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.