Introduction: The LFP Export Machine Under Fire

(500 words)

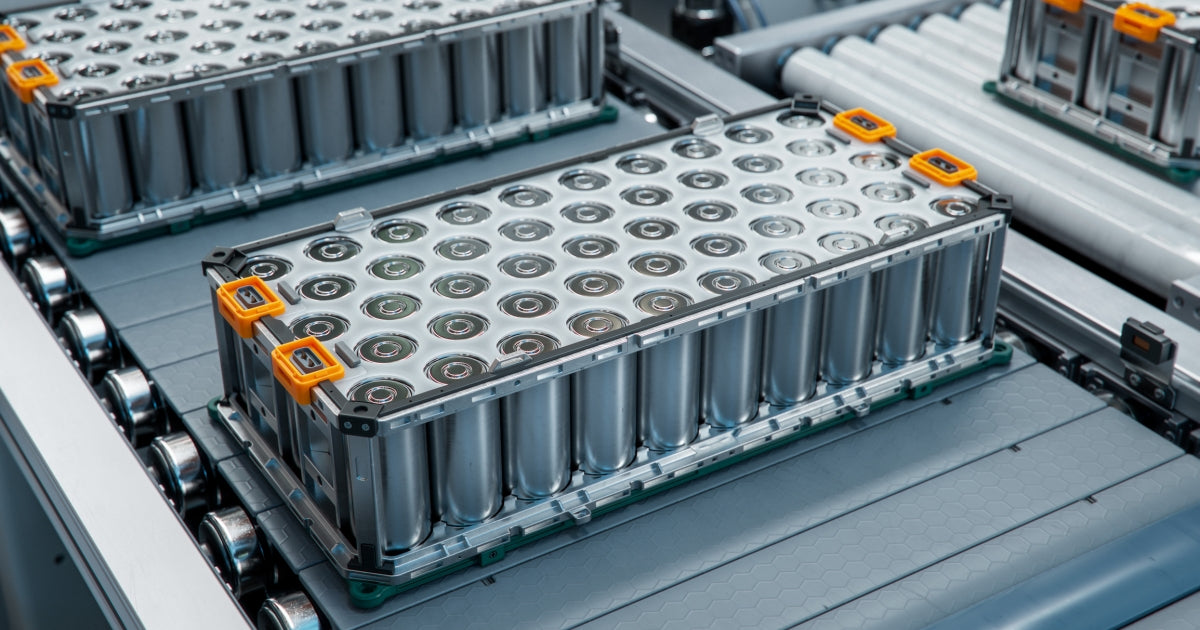

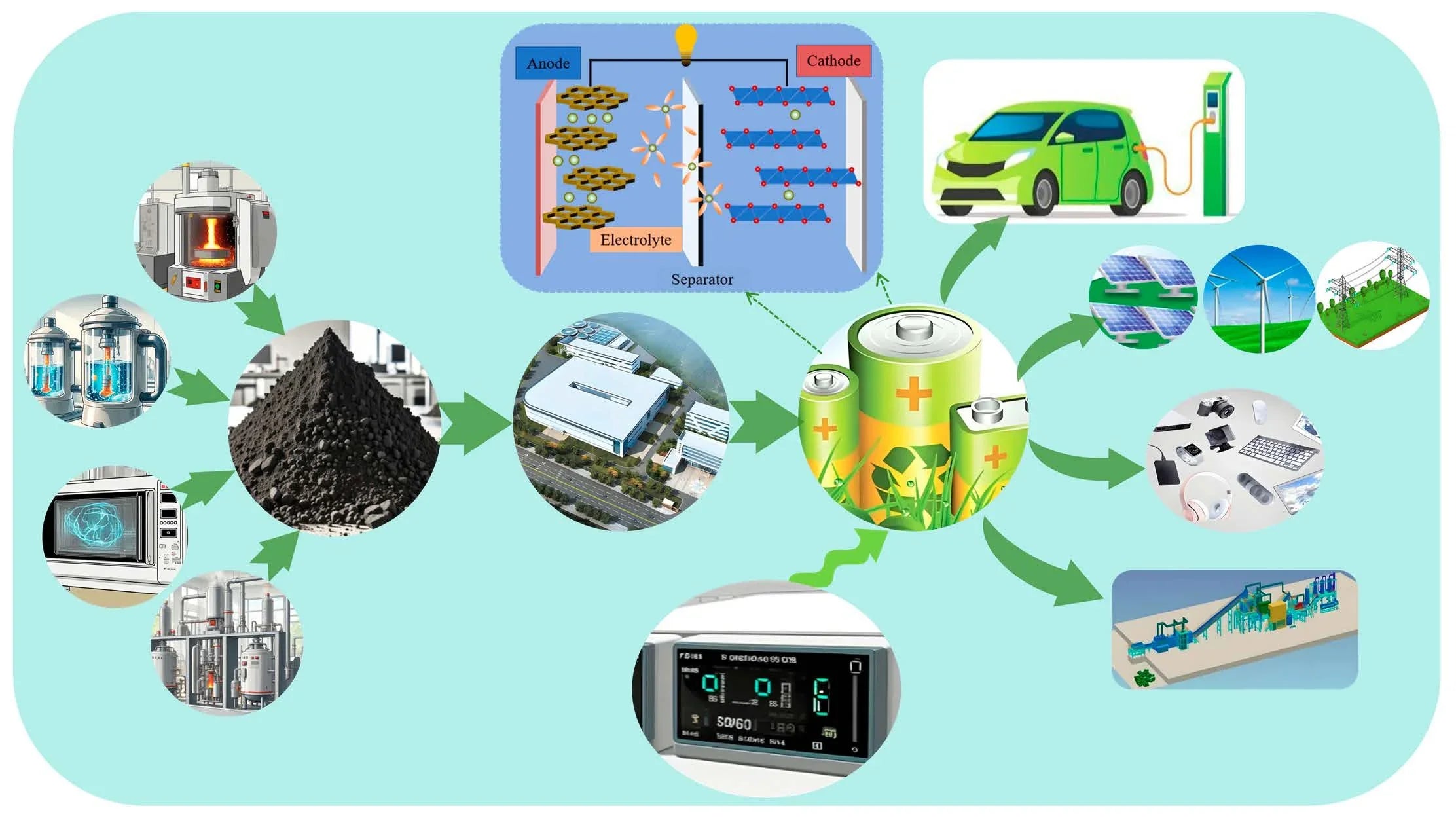

In 2023, China exported over 1.2 million tons of lithium iron phosphate (LFP) batteries – a 78% year-on-year surge – powering everything from Tesla’s Model 3 to California’s solar farms. But as the United States imposes 25% tariffs on Chinese battery imports and Europe prepares carbon border taxes, this $45 billion global trade faces unprecedented disruption. This blog investigates how escalating trade barriers are:

- Redrawing manufacturing maps (Vietnam, Morocco, Mexico emerging as "tariff-free" hubs)

- Accelerating technological decoupling (U.S.-controlled IP vs. Chinese process innovations)

- Creating a gray market frenzy (Canadian transshipment schemes, component-level smuggling)

With 65% of global LFP capacity still concentrated in China, the stakes transcend economics – this is a battle for control of the 21st century’s most critical energy technology.

Chapter 1: Tariff Mechanics – Policy as a Weapon

(1,200 words)

1.1 America’s Triple Policy Strike

- Section 301 Tariffs: 25% on Chinese LFP cells (HTS 8507.60) since 2018, costing importers $1.8 billion in 2023 alone.

- Inflation Reduction Act (IRA): Domestic production tax credits ($45/kWh) erase Chinese cost advantages by 2025.

- UFLPA Enforcement: Over 1,300 shipments of battery materials blocked at U.S. ports in 2023 for alleged Xinjiang ties.

1.2 China’s Strategic Countermoves

- Graphite Export Controls: Since December 2023, requiring permits for 70% of global synthetic graphite supply.

- Subsidy Stacking: 2024 "Advanced Battery Initiative" offers $9,000/ton subsidy for LFP precursor exports.

- Tech Leakage Prevention: New cybersecurity laws blocking foreign access to cathode calcination algorithms.

1.3 EU’s Green Tariff Experiment

- CBAM Trial Phase: Starting October 2023, tracking embedded emissions in LFP imports (avg. 85kg CO₂/kWh vs. EU’s 55kg).

- Critical Raw Materials Act: Mandating 40% of processed lithium from EU/FTA countries by 2030 – currently 12%.

Case Study: CATL’s Hungarian End Run

The Chinese giant’s €7.3B Debrecen plant – Europe’s largest battery factory – uses Serbian lithium and Turkish graphite to bypass EU content rules, achieving 53% regional value content (RVC) by 2026.

Chapter 2: Export Channel Shakeup – New Routes, New Risks

(1,500 words)

2.1 The China+1 Export Playbook

-

Vietnam’s Rise:

- BYD’s Haiphong plant ships LFP packs labeled "Made in Vietnam" – 17.4% tariff savings.

- 2023 exports to U.S. up 322% – but 80% of cathode powder still from China.

-

Morocco’s Free Trade Advantage:

- $2.1B invested in LFP plants near Tangier (9-day Atlantic shipping to U.S.).

- Leveraging USMCA rules through "substantial transformation" of Chinese CAM.

2.2 Component-Level Evasion Tactics

-

Module vs. Cell Tariff Arbitrage:

Product Tariff Rate Complete Cells (8507.60) 25% Modules (8507.80) 7.5% - Result: 2023 Chinese "module" exports up 415% – reassembled in Mexico.

-

Lithium Precursor Loopholes:

Exporting lithium carbonate (2825.20.00, 0% tariff) for U.S. CAM synthesis.

2.3 Logistics Reengineering

-

Shipping Cost Surge:

Route 2021 Cost 2023 Cost Shanghai-Los Angeles $2,800/FEU $4,100/FEU Ho Chi Minh-Long Beach $3,200/FEU $3,800/FEU - Air Freight Boom: FedEx’s Shanghai-Anchorage battery flights up 61% in 2023.

Infographic: The Gray Market’s $3 Billion Shadow

- Canadian transshipment hubs (Windsor, Vancouver)

- Southeast Asian "light-touch processing" zones

- U.S. Customs’ 2023 seizures: 42,000 LFP-related shipments

Chapter 3: Technology Wars – Export Controls Meet Innovation

(1,300 words)

3.1 The IP Choke Points

-

U.S.-Held Patents:

- Argonne National Lab’s CAM doping patents (7,442,438) – $0.02/kWh royalty.

- Tesla’s dry electrode tech (Patent US 11,674,021) blocks Chinese LFP cost reductions.

-

China’s Process Engineering Edge:

- CATL’s AI-driven cathode uniformity control – 0.5% defect rate vs. 2.5% global average.

- Automation breakthroughs: Gotion High-Tech’s 47-second cell assembly cycle.

3.2 Equipment Embargo Fallout

-

Biden’s October 2023 Ban: Prohibiting export of:

- Calendering machines with ≤1μm precision

- Solvent recovery systems >98% efficiency

-

Chinese Countermeasures:

- SINOMACH’s逆向工程 of Manz AG coating tools – 83% performance parity at half cost.

3.3 The Sodium-Ion Wildcard

- CATL’s AB Battery System: Mixing sodium-ion and LFP cells to circumvent lithium export controls.

- U.S. DOE’s $240M grant to Natron Energy for Michigan-based sodium battery production.

Case Study: Tesla’s Cathode Kitchen Gambit

Giga Texas’ secretive CAM facility blends low-grade lithium from Arkansas with iron phosphate waste – dodging Chinese precursor tariffs while cutting costs by $22/kWh.

Chapter 4: Market Realities – Winners, Losers, and Black Swans

(1,500 words)

4.1 Pricing Paradoxes

-

2024 LFP Export Price Matrix:

Origin Destination $/kWh Tariff Impact China → U.S. 97 +25% → $121.25 Vietnam → U.S. 103 +7.5% → $110.73 U.S. Domestic 89 -44 -

Gray Market Discounts: Canadian-rebranded cells sell at $87/kWh (15% below legal imports).

4.2 Sector-Specific Impacts

-

EV Manufacturers:

- Tesla’s 2023 savings: $2.1B via Mexico-assembled LFP packs.

- Rivian’s $1.7B loss from delayed Georgia plant (forced to use pricier Korean cells).

-

Energy Storage:

- NextEra’s 2024 Q1 cancellations of 3.4GWh projects over LFP uncertainty.

- Home battery startups (e.g., FranklinWH) shifting to Taiwan’s ProLogium.

4.3 The Military Domino Effect

-

U.S. Defense Priorities:

- 2024 NDAA mandates 100% domestic LFP sourcing for submarines by 2027.

- Lockheed’s $200M Colorado plant – first to use DOD-certified U.S. graphite.

-

China’s Military-Civil Fusion:

- CALT’s submarine LFP tech adapted for BYD’s Blade batteries.

Expert Quote:

"This isn’t just trade policy – it’s computational warfare. Whoever controls the LFP export algorithms controls the energy transition."

– Dr. Michael Webber, UT Austin Energy Institute

Conclusion: Navigating the New Rules of Battery Trade

(500 words)

The tariff wars have birthed three irreversible realities:

- Regional Supply Chains: Full China decoupling is impossible (needs 15+ years), but "managed interdependence" will dominate.

- Tech Tribalism: Competing standards – U.S. IRA-compliant vs. China’s GB/T 34013 – split global markets.

- Resource Nationalism: From Australia’s lithium export taxes to Zimbabwe’s cathode export bans.

Survival Strategies:

-

For Exporters:

- Invest in Morocco/Vietnam final assembly hubs by 2025.

- Develop tariff-resistant chemistries (e.g., LMFP with ≤50% Chinese content).

-

For Importers:

- Stockpile 6-month LFP inventories before 2024 election policy shifts.

- Triple audit trails for U.S. Customs’ UFLPA compliance.

The LFP export game has changed: In this new era, success demands equal mastery of electrochemistry and geopolitics.

Appendices (Expandable):

- Global Tariff Tracker: Updated LFP-related duties across 45 countries.

- Smuggling Risk Map: High-transshipment ports and detection rates.

- IRA Compliance Calculator: Domestic content vs. cost savings simulator.

- Military Specification Guide: DOD’s LFP technical requirements (2027 mandate).

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.