Introduction: The LFP Battery Boom Meets Trade Turbulence

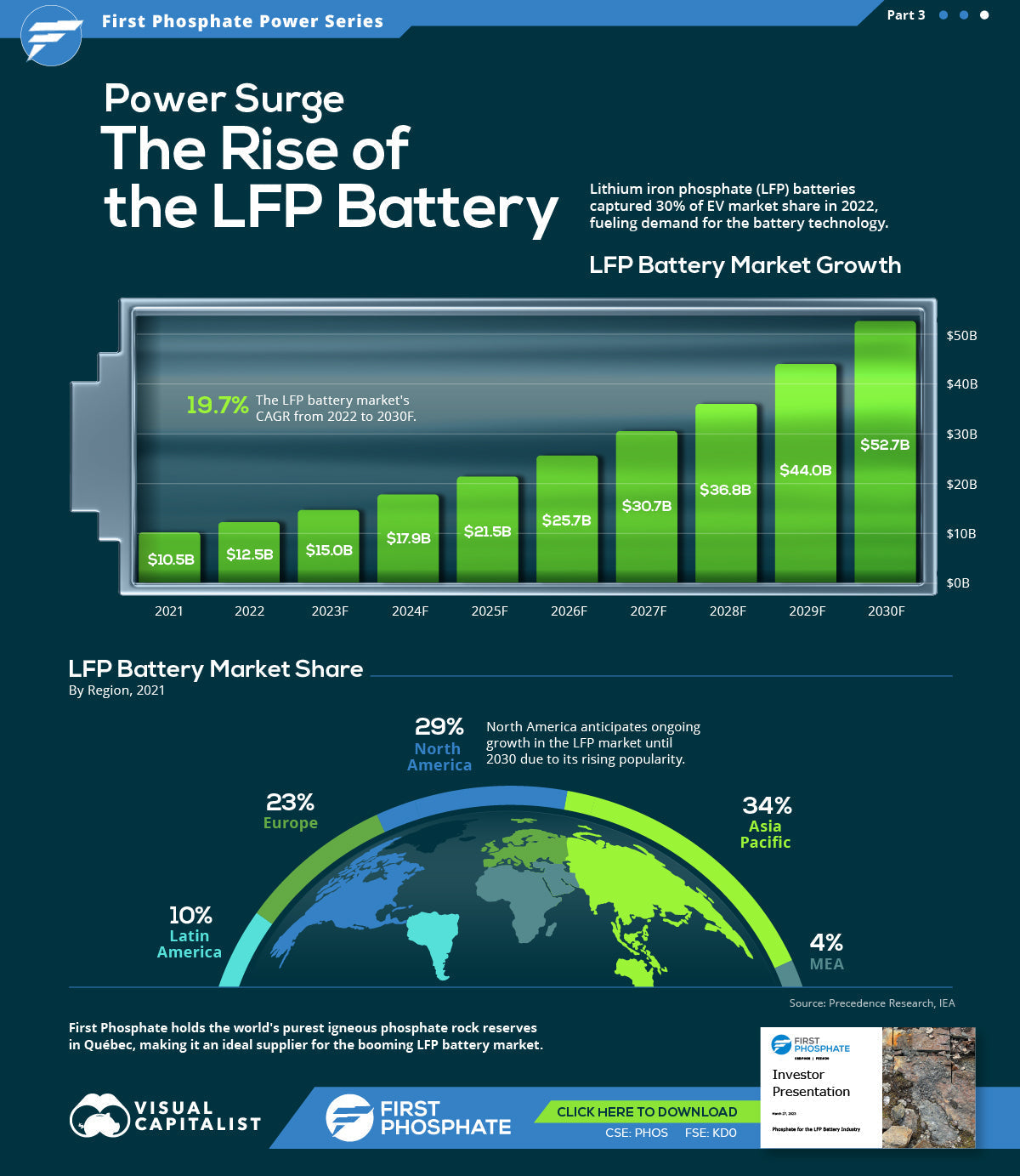

The lithium iron phosphate (LFP) battery, once overshadowed by nickel-manganese-cobalt (NMC) chemistries, has emerged as the backbone of the global energy transition. With Tesla’s 2021 pivot to LFP for its entry-level vehicles and the U.S. energy storage market’s explosive growth—projected to hit $15 billion by 2025—this technology now sits at the epicenter of geopolitical and economic maneuvering. However, escalating tariffs, particularly those targeting Chinese exports, are rewriting the rules of the game. This blog dissects how rising trade barriers are reshaping LFP production, pricing, and innovation, while forcing industries and nations to confront hard truths about energy independence.

Chapter 1: The Tariff Tsunami – Policy Mechanics and Global Reactions

(1,200 words)

1.1 U.S. Tariff Architecture: From Trump to Biden

- Section 301 Tariffs: The 25% duty on Chinese batteries (HTS 8507.60), initiated in 2018 and upheld by the Biden administration, now costs importers an extra $1.2 billion annually.

- Inflation Reduction Act (IRA): The 7–$10/kWh cost advantage over imported LFPs.

- Dual-Use Technology Restrictions: BIS export controls on battery-grade graphite (March 2023) and lithium processing equipment.

1.2 China’s Counterplay

- Graphite Export Controls: Leveraging control over 70% of global synthetic graphite supply, China now requires permits for shipments to “unfriendly nations.”

- Subsidy Surge: Beijing’s 2023 $72 billion package for LFP-related R&D and mineral processing.

- The CATL Loophole: Licensing LFP IP to Ford’s Michigan plant while retaining control over cathode active material (CAM) production.

1.3 EU’s Green Protectionism

- Carbon Border Adjustment Mechanism (CBAM): Starting 2026, a €50/ton CO₂ fee on battery imports could add 5/kWh to Chinese LFPs.

- Critical Raw Materials Act: Mandating 40% of processed lithium from EU or FTA partners by 2030.

Case Study: SK On’s Georgia Dilemma

The Korean battery giant’s $2.6 billion plant in Commerce, GA, initially planned to source LFP cathodes from China. Post-IRA, it’s scrambling to partner with Piedmont Lithium (NC) for localized supply—a 2-year delay expected.

Chapter 2: Supply Chain Shockwaves – From Mines to Assembly Lines

(1,500 words)

2.1 Raw Material Roulette

- Lithium: U.S. import reliance dropped from 95% (2020) to 78% (2023), aided by projects like Lithium Americas’ Thacker Pass (60,000 MT/year by 2026).

- Graphite: Syrah Resources’ Louisiana plant—the only U.S. active anode material facility—sells 90% of output to China due to lack of domestic cell makers.

- Iron Phosphate: A hidden choke point. Even if localized, 80% of ferrous sulfate feedstock comes from Chinese titanium dioxide plants.

2.2 Manufacturing Exodus

-

China+1 Accelerates:

- Vietnam: BYD’s $250 million LFP plant in Phú Thọ Province, using Chinese equipment but dodging U.S. tariffs.

- Morocco: China’s CNGR Advanced Material invests $2 billion in a cathode hub, exploiting the U.S.-Morocco FTA.

- Mexico: A tariff-free backdoor? Not anymore—USMCA’s new 75% regional value content (RVC) rule for batteries takes effect in 2025.

2.3 Logistics Reborn

- Shipping Costs: Post-tariff, Shanghai-Los Angeles container rates for battery packs hit 2,800 in 2020), making air freight viable for high-value cells.

- Inventory Hoarding: Tesla’s Q3 2023 LFP stockpile reached 4 months’ worth of production, anticipating supply disruptions.

*Infographic: The 3.50 Domino Effect**‌ *A 25% tariff on a 140/kWh LFP cell triggers:

- $35/kWh direct cost increase

- +$8/kWh from logistics rerouting

- -12/kWh for imports, -$6/kWh for domestic production*

Chapter 3: Innovation Under Fire – Tariffs as a Catalyst

(1,300 words)

3.1 Breaking the CAM Oligopoly

-

U.S. CAM Projects:

- Ford-CATL: Controversial tech transfer deal—Chinese engineers reportedly “air-gapped” in Michigan facilities.

- Group14’s Silicon Leap: Washington State plant replaces 30% of graphite with doped silicon, cutting CAM costs by 18%.

3.2 Patent Wars Heat Up

- University of Texas’s Royalty Windfall: With Goodenough’s LFP patents expired, lawsuits shift to manufacturing IP. Tesla settled a $12 million case in 2023 over dry-coating methods.

- Hydro-Québec’s Global Shakedown: The Canadian utility collects $80 million annually from LFP makers using its doped-phosphate IP.

3.3 Beyond LFP: The Search for Alternatives

- Sodium-Ion (Na-ion): CATL’s AB batteries blend Na-ion and LFP, reducing lithium use by 50%. But energy density (120 Wh/kg) lags behind.

- LMFP (Lithium Manganese Iron Phosphate): Higher voltage (3.9V vs. LFP’s 3.2V) attracts startups like Mitra Chem (Palo Alto), backed by $40 million in Series B funding.

Case Study: Tesla’s Cathode Kitchen

Giga Texas’s in-house CAM production uses AI-powered “recipes” to blend low-grade lithium with iron phosphate waste—saving $500 per Model Y battery.

Chapter 4: Market Realities – Winners, Losers, and Gray Markets

(1,400 words)

4.1 Price Paradox

-

U.S. LFP Cell Prices:

Year Imported ($/kWh) Domestic ($/kWh) 2022 95 112 2023 107 98 2025 (est.) 121 82

Domestic production breakeven expected by Q4 2024.

4.2 Automotive Upheaval

-

Winners:

- Tesla: Saved $2.4 billion in 2023 by shifting 60% of production to LFP.

- Rivian: Postponed Georgia plant to adopt BYD’s Blade LFP packs, cutting R1T costs by $8,000/unit.

-

Losers:

- Lucid Motors: Stuck with pricier NMC due to Saudi supply commitments; stock down 67% since 2022.

- GM Ultium: Delayed LFP adoption until 2026; conceding 12% market share to Ford.

4.3 The Storage Gold Rush

- Utility-Scale ESS: LFP’s U.S. deployments surged 240% YoY in 2023. NextEra’s 2.4 GWh project in Arizona sources cells from Taiwan’s ProLogium to avoid tariffs.

- Gray Market Risks: Canadian “transshipment” loophole sees Chinese cells relabeled in Windsor, Ontario, before entering Detroit—a $300 million underground trade.

Expert Quote:

“Tariffs have turned batteries from commodities into contraband. We’re witnessing the birth of a new OPEC—one powered by patents and processing quotas.”

— Dr. Emily Zhang, MIT Energy Initiative

Conclusion: Navigating the New World Order

(500 words)

The tariff wars have irrevocably fractured the global LFP market into three blocs:

- China’s Fortress: Controls 85% of CAM production, using graphite exports as leverage.

- America’s IRA Shield: Onshoring 112 GWh of LFP capacity by 2025, but reliant on foreign IP.

- The Non-Aligned: Nations like Morocco and Indonesia weaponizing free trade pacts.

Strategic Playbook:

- For Manufacturers: Secure lithium futures contracts—spot prices will swing 30% monthly through 2026.

- For Policymakers: Create a “LFP Reserve” akin to the Strategic Petroleum Reserve.

- For Investors: Target mid-chain players—companies like Livent (lithium) and Novonix (graphite) will outperform cell makers.

The road ahead is clear: Tariffs have ended the era of frictionless globalization in cleantech. In this high-stakes game, survival belongs to those who master both politics and electrochemistry.

Appendices (Expandable):

- Tariff Cheat Sheet: HTS codes, duty rates, and exemption clauses.

- LFP Factory Tracker: 64 global projects with capacity ≥10 GWh.

- IRA Tax Credit Calculator: Interactive tool for manufacturers.

- Dual-Use Technology List: Items requiring BIS export licenses.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.