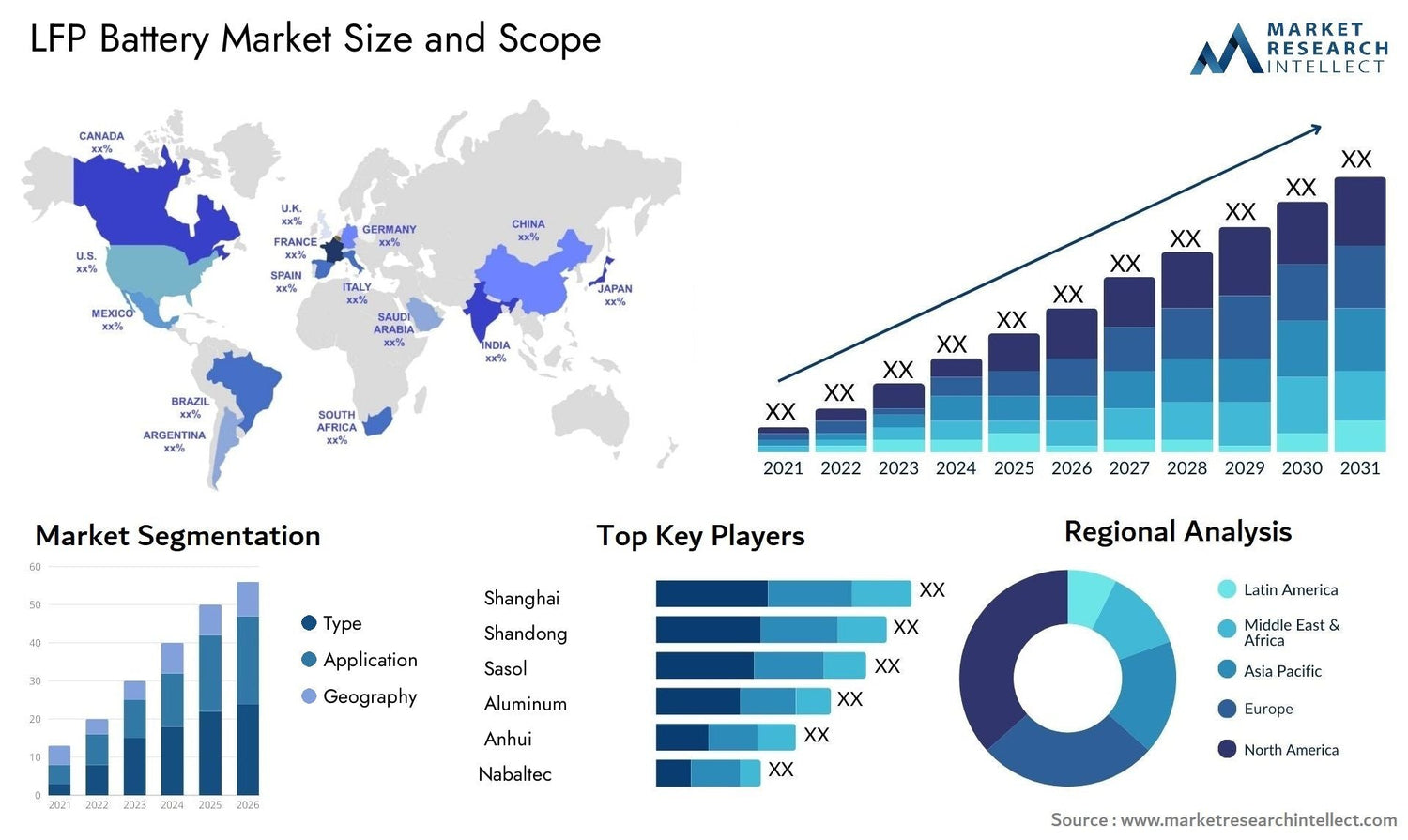

1. Market Size & Growth Projections

Current Market Valuation

-

2025 Market Size: €4.2 billion (37.8% CAGR since 2020)

-

Unit Shipments: 18.7 GWh annually (+412% vs 2022)

-

Segment Breakdown:

-

Automotive: 62%

-

Stationary Storage: 33%

-

Industrial/Marine: 5%

-

Regional Distribution

CountryMarket ShareKey Growth DriversGermany34%Automotive adoption, policy supportFrance22%Renewable integration, nuclear phase-outNordics18%Cold climate optimizationBenelux11%Logistics electrificationSouthern EU15%Solar+Storage boom

2. Supply Chain & Manufacturing

Production Capacity

-

Operational Gigafactories: 7 facilities (total 48 GWh capacity)

-

Under Construction: 12 projects (84 GWh planned)

-

Localization Rate: 41% of materials sourced within EU

Key Players

-

Northvolt (Sweden): 16 GWh LFP capacity online Q3 2025

-

Verkor (France): Dunkirk plant at 65% completion

-

BMZ Group (Germany): 8 GWh annual output

-

Asian Imports: 59% of market (CATL/BYD dominant)

3. Price Trends & Cost Breakdown

Current Pricing

-

Cell-Level: $92-105/kWh (-42% since 2020)

-

Pack-Level: $127-142/kWh (including BMS)

-

System-Level: $155-175/kWh (stationary storage)

Cost Structure Analysis

Component2025 Cost ShareTrendCathode Material38%↓7% YoYAnode12%↑2% (graphite shortages)Electrolyte8%StableManufacturing25%↓15% (scale benefits)Other17%-

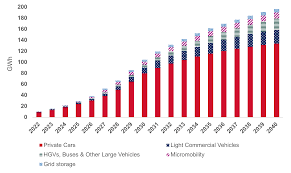

4. Demand Drivers by Sector

Automotive Applications

-

EV Penetration: 38% of new models offer LFP option

-

Fleet Operators: 72% prefer LFP for total cost of ownership

-

Projected 2030 Demand: 87 GWh annually

Energy Storage Systems

-

Residential: 78% market share in new installations

-

Utility-Scale: 5.2 GWh deployed in 2024

-

Commercial/Industrial: 42% growth YoY

5. Policy & Regulatory Impact

Key Regulations

-

Battery Passport: Mandatory from 2026

-

Carbon Footprint Rules: Max 60kg CO₂/kWh by 2027

-

Recycling Targets: 70% material recovery by 2030

Subsidy Programs

-

Germany: €3,000/kWh for residential storage

-

France: 40% tax credit for commercial systems

-

EU Innovation Fund: €3.4 billion allocated

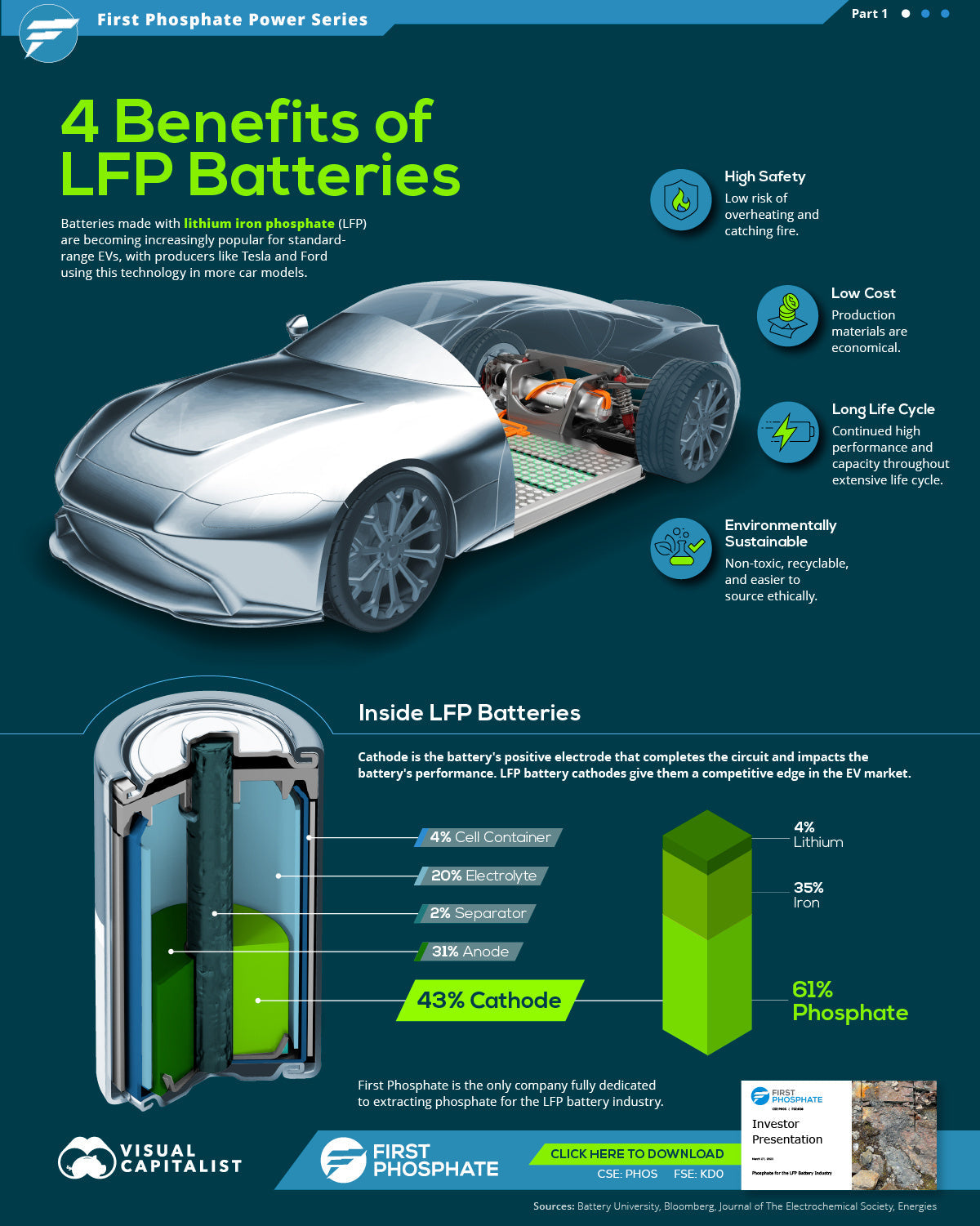

6. Technological Advancements

Performance Metrics

-

Energy Density: 175-190 Wh/kg (cell level)

-

Cycle Life: 6,000+ at 80% DoD

-

Charging: 22min (20-80%) in latest EV models

Innovations

-

Silicon-doped anodes (+18% capacity)

-

Dry electrode processing (-22% energy use)

-

AI-optimized battery management systems

7. Competitive Landscape

Market Share

-

CATL: 32% (Hungary plant expansion)

-

BYD: 18% (via local partnerships)

-

Northvolt: 14% (growing rapidly)

-

Others: 36%

Strategic Alliances

-

14 automaker-supplier JVs announced in 2024

-

8 new recycling partnerships formed

-

Cross-border raw material agreements

8. Challenges & Barriers

Supply Chain Risks

-

72% lithium imports from non-EU sources

-

Graphite supply constraints

-

Shipping bottlenecks affecting delivery

Technical Hurdles

-

Cold weather performance gaps

-

Energy density limitations vs NMC

-

Standardization issues across markets

9. Future Outlook (2025-2030)

Projections

-

Market Size: €28 billion by 2030

-

Production Capacity: 120 GWh annually

-

Price Trajectory: $78/kWh by 2027

-

Market Share: 55% of stationary storage

Emerging Opportunities

-

Second-life applications

-

Marine electrification

-

Grid-forming inverters integration

Conclusion

The European LFP battery market stands at an inflection point, with data indicating sustained exponential growth through the decade. While challenges remain in supply chain security and technological refinement, the fundamental economics and policy tailwinds position LFP as the dominant battery chemistry for Europe's clean energy future.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.